Understanding Gas Taxes: A Crucial Cost for Drivers

As Americans hit the roads in 2025, the conversation around gas taxes has intensified. These taxes, often seen as just another cost of driving, serve a critical purpose: funding the maintenance and repair of our roads and infrastructure. Typically, gas taxes are structured as per-gallon excise taxes, but they can also include additional sales taxes and fees imposed at various points in the supply chain. The result? A complex web of costs that can make filling your tank a significant financial commitment, depending on where you live.

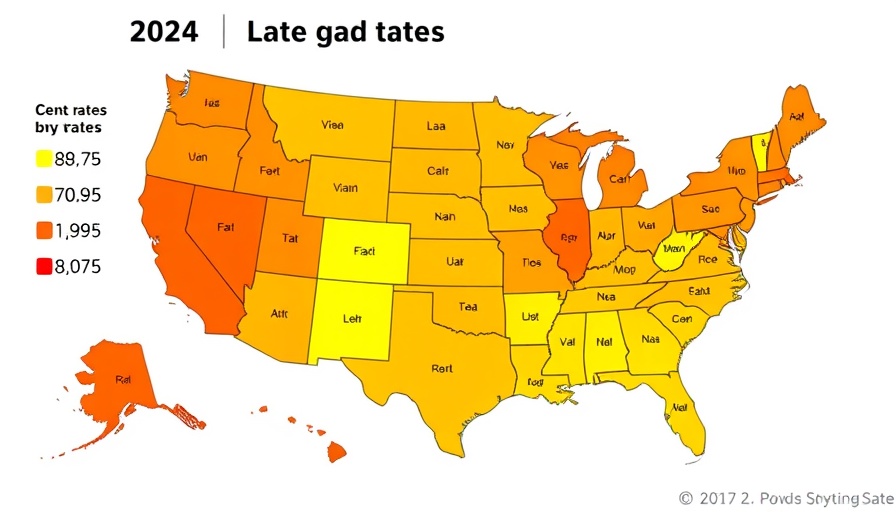

The Disparity Between States

The landscape of gas taxes varies drastically from state to state. In 2025, California leads the nation with the highest gas tax set at 70.9 cents per gallon, a reflection of the state's environmental initiatives and infrastructure needs. Following closely is Illinois at 66.4 cents per gallon and Washington at 59.0 cents. In contrast, states like Alaska (8.95 cents), Hawaii (18.5 cents), and New Mexico (18.9 cents) maintain significantly lower rates, often reflecting their unique geographic and economic situations.

Why Gas Taxes Matter

These taxes are more than just numbers on a receipt; they are funds that support crucial public services. When drivers pay gas taxes, they contribute to the maintenance of highways, bridges, and public transport systems. This user-pay model attempts to distribute costs fairly among those who use these services, ideally leading to better-funded and safer roads. Yet, the steep variation in gas tax rates can create a cost burden that affects daily commuting and overall living expenses in different regions.

The Future of Gas Taxes

Looking ahead, it’s essential to consider how gas taxes may evolve in response to changes in transportation needs and environmental policies. With the rise of electric vehicles and alternative fuel sources, states may need to rethink their funding models for road maintenance and infrastructure. This creates an opportunity for innovation in tax structures, potentially leading to more equitable and sustainable transportation funding.

Conclusion

Understanding gas taxes is essential for drivers, especially as rates evolve and infrastructure needs continue to grow. By staying informed, drivers can better anticipate how these costs will impact their wallets and advocate for fairer policies that consider the needs of all citizens.

Add Row

Add Row  Add

Add

Add Row

Add Row  Add

Add

Write A Comment