Understanding the Tax Competitiveness-Migration Connection

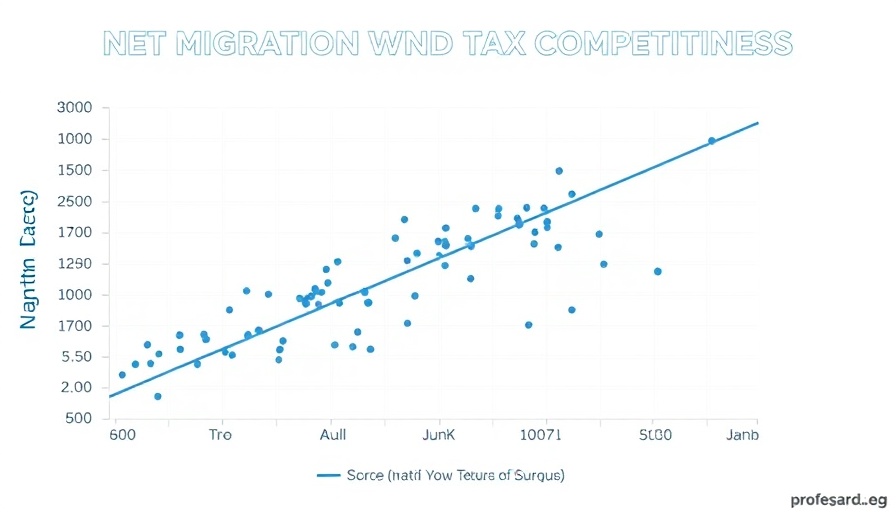

New evidence suggests that states with well-structured tax systems attract more newcomers, according to the State Tax Competitiveness Index (STCI). This recent analysis uses data from the American Community Survey to illustrate a strong link between efficient tax codes and positive interstate migration patterns from 2021 to 2023. Notably, top STCI states like Florida, Texas, and Tennessee gained a significant number of new residents, while those at the bottom, including California, New York, and New Jersey, saw a mass exodus.

Future Predictions and Trends in Tax Policy

As states continue to rethink their tax structures post-pandemic, the trend of tax competitiveness influencing population movement is likely to persist. Policymakers are increasingly being advised to prioritize tax reforms to not only boost economic growth but also to retain and attract residents. This shift could signal a new wave of strategic tax modifications aiming to enhance statewide competitiveness.

Relevance to Current Economic Challenges

The correlation between tax policies and migration gains importance against the backdrop of current economic uncertainties. With individuals and businesses seeking destinations with lower tax burdens, understanding these dynamics becomes crucial. For many, the choice of where to live or operate a business is significantly influenced by tax considerations, prompting states to weigh their competitive tax positions carefully.

Add Row

Add Row  Add

Add

Add Row

Add Row  Add

Add

Write A Comment