Capital Gains Tax in Europe: Understanding the 2025 Landscape

As investment income, like dividends and capital gains, comes with its own unique tax implications, understanding the capital gains tax rates across Europe is vital for investors. Capital gains tax is charged on the profit made from selling an asset, which can include stocks and real estate. For instance, if an individual spends €100 to buy a stock and sells it for €120, the capital gains tax will apply to the €20 gain, impacting investment decisions significantly.

The Consequences of High Tax Rates

One key takeaway from the tax landscape is that higher capital gains tax rates may discourage saving and investment. This is evident with the realization or lock-in effect, where investors hold onto their assets longer due to the tax implications of selling, ultimately hindering economic growth in various economies. For example, while Austria levies a 27.5% tax, countries like Belgium and Cyprus have intricate exemptions making capital gains non-taxable under certain conditions, promoting a more investment-friendly environment.

Comparing Tax Rates: A Broader Perspective

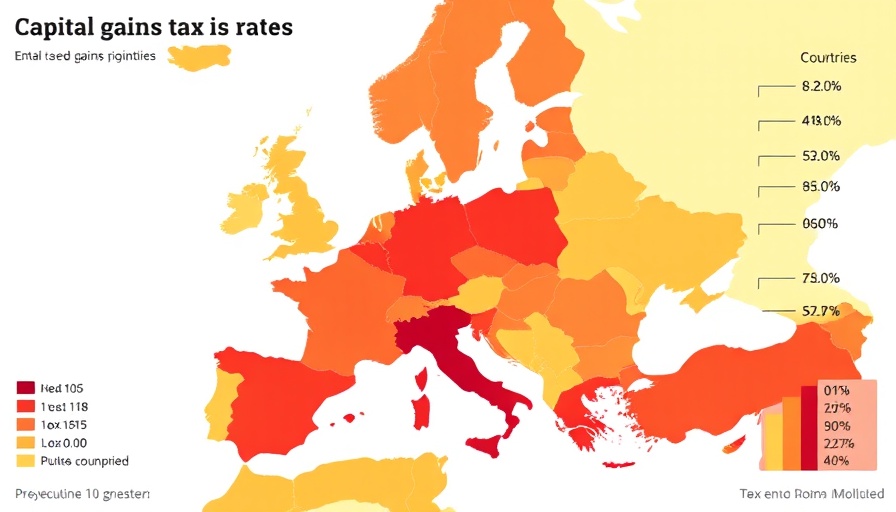

In considering where to invest within Europe, the differences in capital gains tax rates become crucial. For instance, as of 2025, Bulgaria fosters investment with a mere 10% capital gains tax, while Germany’s rate remains higher at about 26.4%. The interactive map provided by institutions such as the Tax Foundation allows investors to gauge their options effectively, weighing the tax implications in various countries and planning their long-term financial strategies accordingly.

Cultural Implications of Tax Structures

The way countries structure their tax systems is reflective of broader cultural attitudes toward investment and economic growth. For instance, Nordic countries like Denmark and Finland have relatively high capital gains tax rates (up to 42%), but also emphasize social welfare systems funded by these taxes. This contrasts starkly with more laissez-faire economic environments in Eastern European nations like Bulgaria and Estonia that encourage lower tax burdens to attract foreign investments.

Looking Ahead: Future Trends in Taxation

As global economic conditions evolve, so too will the landscape of capital gains taxation in Europe. There are advocacy efforts aiming to harmonize tax rates across the EU, which aim to mitigate discrepancies that could distort investment flows. Watching these developments could be crucial for investors aiming to maximize their investment returns while navigating complex tax environments.

The knowledge of capital gains tax rates is essential as they play a significant role in determining investment strategies. As markets shift, staying informed will lead to better financial decisions. It’s important for investors to explore how the varying rates can impact returns in their preferred investment locales.

Add Row

Add Row  Add

Add

Add Row

Add Row  Add

Add

Write A Comment