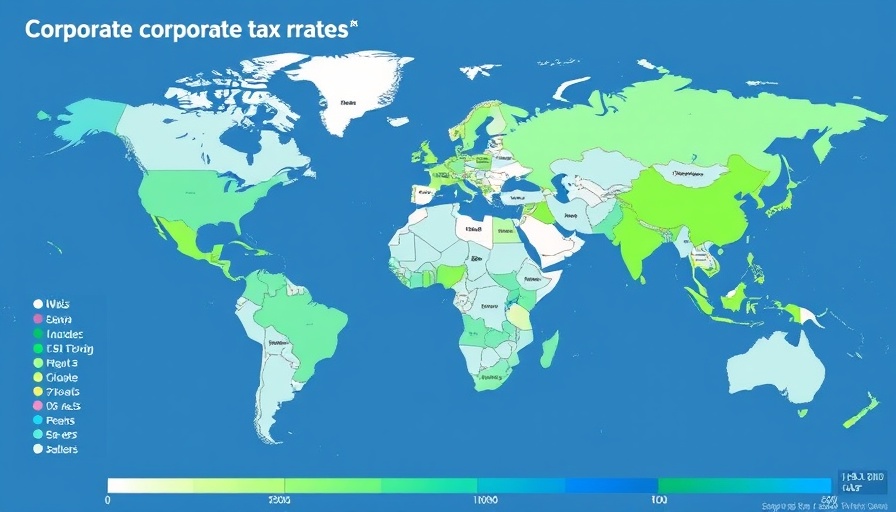

Global Shift in Corporate Tax Rates: A 2024 Overview

In 2024, a dynamic shift is occurring in the realm of corporate tax rates worldwide, reflecting both strategic economic policies and international agreements. Thirteen countries have altered their statutory corporate income taxes, resulting in eight countries, including Iceland and Czechia, increasing their tax rates, while countries such as Austria and Rwanda have opted to reduce them. This move underscores a trend of countries calibrating their financial strategies to foster business growth or enhance state revenues.

Historical Context: The Evolution of Corporate Tax Rates

Corporate tax rates have seen a significant transformation over the years. Back in 1980, the global average was a hefty 40.18 percent, highlighting a time when higher rates were standard to boost government funds. Fast forward to 2024, the average has decreased dramatically to 23.51 percent, showcasing a common strategy to attract business investment by creating a more favorable tax environment. This historical shift signifies how nations are repositioning economically to remain competitive on a global scale.

Future Trends: The Impact of Global Minimum Tax

A noteworthy development in 2024 includes the adoption of the qualified domestic minimum top-up tax (QDMTT) and other measures under the OECD's framework, which are influential in shaping future corporate tax landscapes. Notably, five countries with low statutory rates have adjusted to meet the minimum tax of 15 percent stipulated for large corporations. This trend indicates a move towards harmonization in international tax policy, likely steering more nations to align their rates with global standards to ensure fair competition.

Relevance to Current Economic Dynamics

The adjustments in corporate tax rates are remarkably timely, aligning with ongoing global economic shifts and market uncertainties. With regions like South America marking the highest average statutory rates, and contrasting lower averages in Asia, these changes can significantly influence global business decisions and investment flows. Understanding this landscape is crucial for businesses navigating international markets to optimize strategic planning, especially in the tech-driven world highlighted by emerging innovations and digital economies.

Add Row

Add Row  Add

Add

Add Row

Add Row  Add

Add

Write A Comment