Gas Prices Drop Amid Rising Demand: What You Need to Know

The latest data from AAA reveals that despite an uptick in gasoline demand, the national average price for a gallon of gas has decreased to $3.07. This marks an 8-cent dip over the past month and a 31-cent reduction from this time last year, with overall demand rising from 8.87 million barrels per day to 9.18 million.

Interestingly, the overall domestic gasoline supply has also declined, dropping from 246.8 million barrels to 241.1 million barrels—slightly below seasonal averages. Production has averaged about 9.6 million barrels per day, which is contributing to a tricky balance between demand and supply as the nation heads into the busy travel season for spring break.

Regional Price Variations: A Closer Look

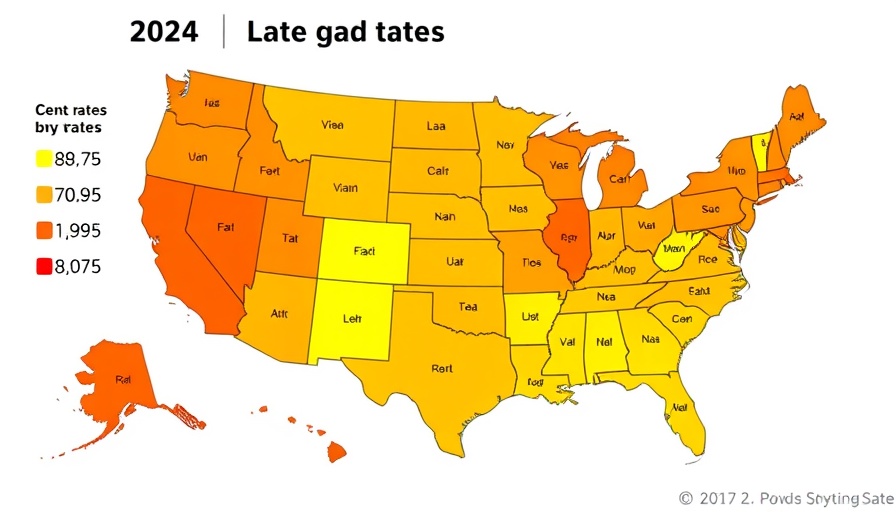

Across the country, gas prices vary significantly. The most expensive markets are on the West Coast, with California hitting $4.66 per gallon, while Mississippi boasts the lowest at just $2.64 per gallon. This discrepancy highlights regional factors, such as taxes and proximity to refineries, affecting prices. For instance, Texas and Kentucky also offer relatively lower gas prices at $2.66 and $2.68, respectively.

Despite some states showing minor shifts, 31 states have seen prices drop below $3 per gallon, making fuel more accessible as travel picks up with the arrival of warmer weather.

Monitoring Trends: What Lies Ahead?

The energy landscape hints at fluctuations in prices moving forward. According to the U.S. Energy Information Administration (EIA), crude oil prices rose to $67.68 per barrel recently, following a decline in U.S. crude oil inventories. Consequently, analysts are urging consumers to stay informed as the spring progresses, as seasonal fluctuations typically bring price hikes.

The gas market remains vulnerable to geopolitical tensions and economic factors, which may shift predictions on price movements in the upcoming months. Insights from industry analysts suggest that while the current trend is favorable for consumers, various unpredictable influences could alter this landscape, necessitating close monitoring.

Add Row

Add Row  Add

Add

Add Row

Add Row  Add

Add

Write A Comment